General Overlook and Team

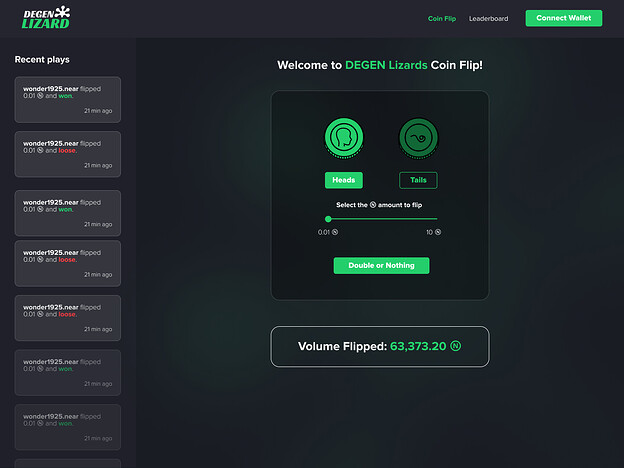

Degen Lizards is the first casino on the NEAR Blockchain with %3 giving back to our holders from casino fee’s. The team includes:

1x Backend Dev - woothugg which created the coin flip game.

2x Community Managers - cryptobaikan, winebanks hosting events in discord and twitter.

1x Marketing Manager - Bobo-Bush pushes marketing on twitter and creates events.

1x Designer - We hired a freelance designer for the coin flip UI and also for future utilities.

1x Frontend Dev - We also hired one more freelancer for the frontend dev to work on implementing the designs to the site.

New designs ready to be deployed when frontend dev finishes his job on the coin flip game.

What We Have Achieved So Far

We’ve minted with a price of 5 Near with a 1000 supply. Near’s price was at 10.5$ at that time and we raised approximately 52.5k$. With the coin flip game that we had we managed to bring volume over 1M$ and approximately distributed 30k$ to our holders.

Roadmap 2.0

We’re building a P2P lending protocol in which anyone can create a loan request using their NFTs as collateral. The applicant can specify their terms (i.e., loan amount, interest rate, and term) and lenders can then browse the marketplace of loan listings to find a loan request they want to fulfill.

How it Works?

To help you understand how P2P lending works, consider this example:

Let’s say the floor for Monarchs is 40 NEAR.

Kenny has a Monarch and needs NEAR for an upcoming mint (or maybe he wants to buy the dip on another project).

He creates a new listing, asking for a 30-day loan of 30 NEAR with 10% interest at maturity (i.e., he will have to pay back 33 NEAR after 30 days to get his collateral back).

Misfires sees this listing and is interested. He can accept the terms offered and Kenny will receive his loan of 30 NEAR.

Misfires accepts, grants the loan, and the 30 NEAR is sent to Kenny while his Monarch is placed in escrow as collateral.

Kenny uses his cash and returns 30 days later to repay the loan with interest and get his Monarch back. If Kenny is unable to pay back his loan within the allotted time, he loses his collateral to Misfires.

Why Use P2P Loans?

While automated loan pools can provide instant liquidity (a big advantage, of course), a perceived weakness is that these protocols necessarily take as little risk as possible by offering low LTVs (loan-to-value) - often with short terms and high APYs - which creates unfavorable conditions for borrowers.

In addition, traditional loan markets are highly dynamic and subject to several variables such as Fed interest rates and general market conditions. Because crypto-currency prices move particularly quickly, automated protocols may struggle to account for all variables in a way that protects their own assets, but also provides value to borrowers.

We believe that allowing lenders to define their own risk/reward will create a win-win scenario for both borrowers and lenders.

Borrowers will be able to achieve higher LTVs with longer terms and lower APYs through a privatized arrangement, and lenders will be able to outperform by providing loans backed by NFTs that they would be happy to own in the event of default.

Another strength of an individualized P2P lending market is that it creates a lending market for scarce NFTs.

It is a well-known fact that it is difficult to scale an NFT project.

As the project grows, they price new entrants and their profits are reserved for a small number of elites. Great for building a close community.

Balancing the usefulness of a project between NFTs and tokens is one of the easiest ways for the wider accessibility and future growth of the community.

Staking not only distributes tokens fairly, but also creates amazing incentives for long-term project holders. Long-term project owners can adjust yields based on how long they are willing to lock NFTs.

As staking becomes more popular, developers are spending weeks from the roadmap working on what was created by dozens of other projects that don’t offer differentiation.

The value comes not from the creation of these stake programs, but from creative project managers who can build interesting utilities around the tokens people receive. Developing an NFT staking program is a participation fee for a new project and we want to save time and resources so that we can focus on what really adds value to the community.

One Stop Shop for all you NFT staking needs

We’re building a new NFT staking standard on NEAR where anyone can easily integrate their NFT project :

This new NFT staking standard offers:

Rarity based rewards

Fixed and variable rewards

Cooldown / Locking periods

Despite the fact that NFTs have garnered significant attention across the crypto and DeFi verses, they are still part of a market that has yet to show its true colors. NFTs are walking along their first stages, and just starting to blossom into an eruptive force of nature that is poised to reshape our environment.

Currently, they mostly are bought and sold via marketplaces. While marketplaces provide a well-established and solid foundation for trading, they lack the true liquidity that markets need to thrive.

What’s Liquidity

Liquidity represents one of the true foundations of DeFi. Liquidity pools replace traditional middlemen through an assemblage of funds locked within smart contracts that allow trades to be executed unilaterally, with decentralized exchanges — or DEXs — taking the other side of a trade. Liquidity pools have been leveraged through the use of Automated Market Makers — or AMMs. For there to be funds inside the smart contracts, users — called Liquidity providers (LPs) — are required to deposit both assets. In exchange for the liquidity provided to the pool, LPs are compensated in the form of protocol trading fees charged by the said pool. Overall, these pools help bootstrap liquidity within the network, maintain the decentralized nature of the crypto markets, and provide seamless trading without the need for intermediaries.

NFTs and Liquidity

Being inherently unique by nature results in NFTs being burdened by several shortcomings. Due to the complex process resulting from pricing and trading unique assets, NFTs suffer from liquidity shortages. Moreover, there are currently no alternatives as to earn passive income with NFTs, thereby limiting their utility and only enticing their trading by the promise of price appreciation. Fundamentally, this means that creators can only earn a profit from the increase in the value of the NFT and subsequent purchasing of it to complete the sale.

As the market continues to grow, additional liquidity is destined to continue to pour in from new entrants, helping it further expand and permeate new boundaries of application. However, this long-sought liquidity the NFT market awaits requires incentive mechanisms that are not yet present. DeFi systems and solutions are currently being built to establish the underlying architecture required to fully support instant and seamless liquidity to fully release the true power and use case of NFTs. This is the essential missing piece needed to ultimately attract investors spanning from an institutional to retail level on a major scale.

Our Vision

Providing instant and seamless liquidity is at the forefront of our agenda — we’ve stepped in the ring to find the most optimal solution for this issue. Ultimately, our grand vision is to create an ecosystem where sufficient liquidity is available at all times to enable better price discovery.

Our protocol is to utilize AMM systems from external DEXs to merge the benefits of DeFi with digital NFT creations in a coherent and fluid ecosystem, giving all creators and artists a full range of services.

How it Will Benefit NEAR Ecosystem

- P2P NFT Loan Platform will help unlock liquidity into NFTs and for users to define the risk they want to take on instead of the alternatives.

- Staking as a Service will help projects in the NEAR ecosystem provide more utility to their communities.

- Instant NFT Liquidity Pools will unlock instant liquidity for NFTs and would help to unlock the power of Defi into NFTs.

Funding

In order to create these platforms we will need approximately 50k$. We will break down below how these funds will be used;

5K for marketing the coin flip game.

15.6K for community management. (1.3k per month for 12 months)

4.4K to pay mods.

5K for P2P loan platform frontend.

10K for the staking as a service backend/smart contract. (We need to hire more devs)

5K for staking as a service frontend.

5K for marketing of staking as a service.